Investment and Capital Corporation of the Philippines will act as one of the domestic underwriters for Double Dragon Properties’ initial public offering (IPO) of its real estate investment (REIT) trust worth P14.71 billion.

In its Feb. 16 decision, the Securities and Exchange Commission (SEC) approved the registration statement of DDMP REIT Inc. for 17,827,465,406 common shares for listing on the Philippine Stock Exchange, it said in a statement.

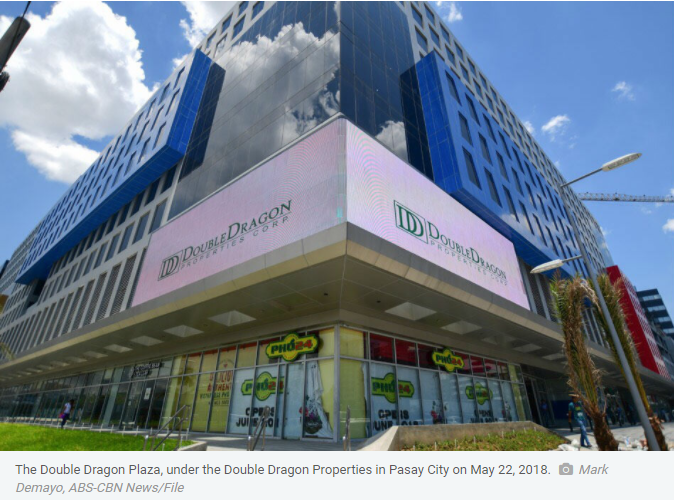

“The Securities and Exchange Commission has considered favorably the nearly P14.71 billion initial public offering (IPO) of a real estate investment trust (REIT) largely sponsored by DoubleDragon Properties Corp,” it said.

DoubleDragon set the maximum offer price at P2.25 apiece, the statement said. The SEC said the company planned to conduct the IPO from March 5 to 11 and debut at the stock exchange on March 19.

The company will offer up to 5,942,488,469 common shares to the public which are currently owned by DoubleDragon, Benedict V. Yujuico and Teresita M. Yujuico, the SEC said. Some 594,248,847 shares were set aside for overallotment.

New investors will hold as much as 36.67 percent of interest, DoubleDragon will retain 44.33 percent while the Yujuicos with 9.65 percent and 9.35 percent, respectively, the SEC said.

Credit Suisse Ltd, DBS Bank Ltd, Nomura Singapore Ltd and PNB Capital and Investment Corp will act as joint global coordinators for the offering, the regulator said.

Credit Suisse, DBS, Nomura, CIMB, Macquarie, and Maybank are the bookrunners while ICCP is joined by PNB Capital and RCBC Capital as domestic underwriters.

DDMP’s portfolio includes 6 office towers within the DD Meridian Park.

*Note: Article is originally published in www.news.abs-cbn.com on Feb. 17, 2021.